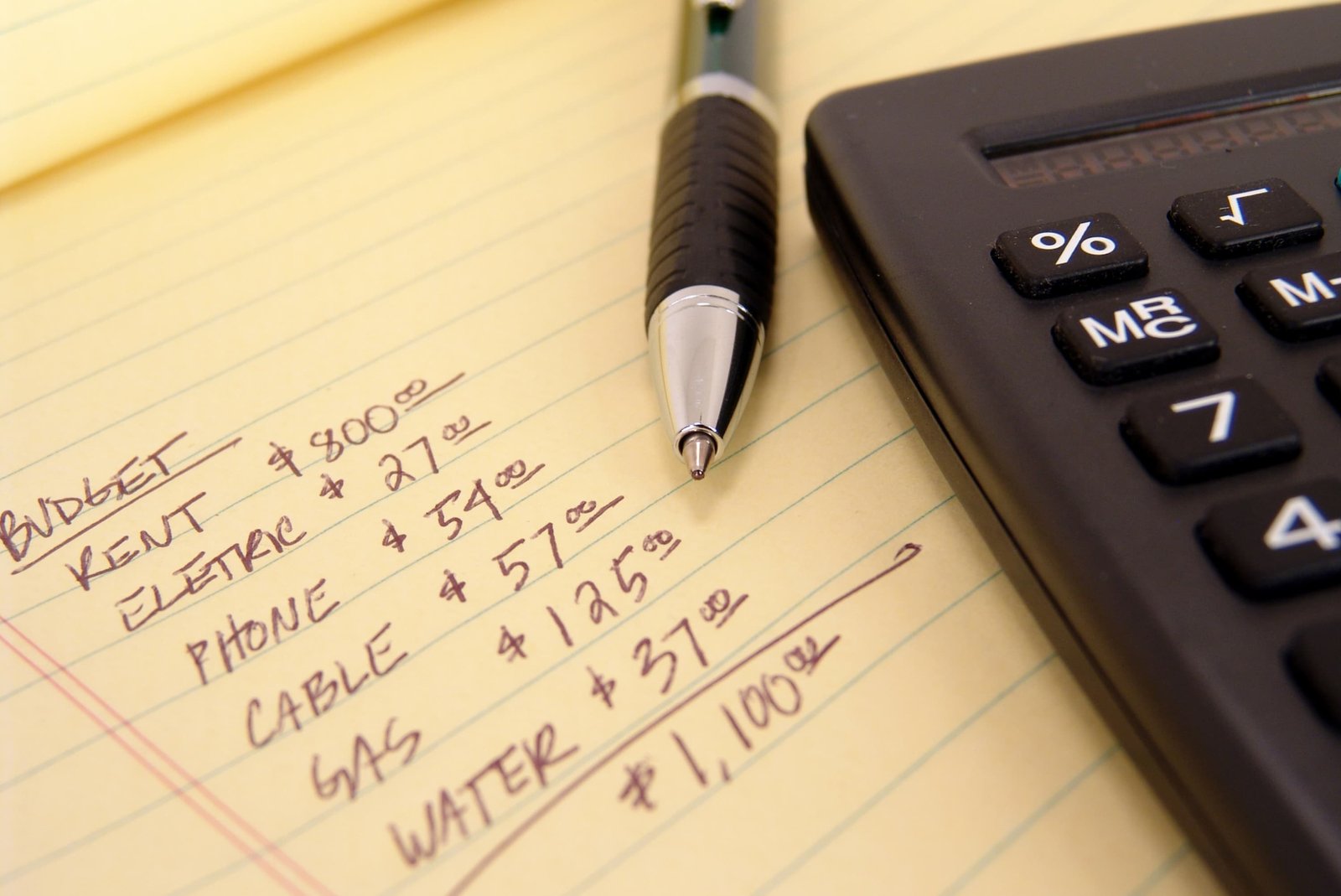

Budgeting

Budgeting is the cornerstone of financial planning. It involves creating a plan for how you will spend your money each month. A well-structured budget allows you to allocate funds for necessities, savings, and discretionary spending, helping you avoid overspending and ensuring that you live within your means. By tracking your income and expenses, you can make informed decisions about your spending habits and identify areas where you can cut costs. Budgeting also helps you set financial goals and work towards them, whether it's paying off debt, saving for a major purchase, or building an emergency fund. Regularly reviewing and adjusting your budget can lead to greater financial stability and peace of mind.

Saving

Saving is essential for building financial security. By setting aside a portion of your income, you create a financial cushion for emergencies and future goals. Consistent saving habits can lead to significant wealth accumulation over time, providing a safety net and enabling long-term planning. Whether you're saving for a down payment on a house, a child's education, or your retirement, having a savings plan is crucial. It's important to make saving a priority in your budget and to choose the right savings vehicles, such as high-yield savings accounts, certificates of deposit, or retirement accounts, to maximize your savings potential. Automating your savings can also help ensure that you consistently put money aside.

Investing

Investing is the process of using your money to generate more wealth over time. By investing in assets like stocks, bonds, or real estate, you can grow your money and build a more secure financial future. Understanding different investment strategies and risk tolerance is crucial for making informed decisions. Diversifying your investments can help spread risk and increase the potential for returns. It's important to have a clear investment plan that aligns with your financial goals and time horizon. Regularly reviewing and adjusting your investment portfolio can help you stay on track and take advantage of market opportunities. Investing can be a powerful tool for achieving long-term financial growth and stability.

Debt Management

Effective debt management involves understanding and controlling your debt. It includes strategies for paying down existing debts, avoiding unnecessary borrowing, and managing credit wisely. Reducing and managing debt is key to improving your financial health and increasing your ability to save and invest. Creating a debt repayment plan, such as the snowball or avalanche method, can help you systematically pay off debts. It's also important to monitor your credit report and score, as maintaining good credit can open doors to better financial opportunities. Avoiding high-interest debt and consolidating debts at lower interest rates can also help you manage your debt more effectively and reduce financial stress.

Retirement Planning

Retirement planning is the process of determining how much money you need to retire comfortably and developing a strategy to achieve that goal. It involves saving and investing in retirement accounts, understanding social security benefits, and planning for long-term healthcare needs. Starting to save for retirement early in your career can take advantage of the power of compound interest, allowing your savings to grow significantly over time. It's important to regularly review and adjust your retirement plan to ensure that you are on track to meet your goals. Consider consulting with a financial advisor to create a comprehensive retirement plan that addresses your specific needs and objectives.

Insurance

Insurance is a vital part of financial planning. It protects you and your loved ones from financial loss due to unexpected events such as illness, accidents, or natural disasters. Understanding different types of insurance and choosing the right policies is crucial for safeguarding your assets and financial well-being. Common types of insurance include health, life, auto, homeowners, and disability insurance. Each type of insurance serves a specific purpose and provides coverage for different risks. It's important to assess your insurance needs and periodically review your policies to ensure that you have adequate coverage. Proper insurance planning can provide peace of mind and financial security for you and your family.

Tax Planning

Tax planning involves strategically managing your finances to minimize your tax liability. By understanding tax laws and utilizing deductions, credits, and tax-advantaged accounts, you can reduce the amount of taxes you owe and maximize your savings and investments. Effective tax planning requires staying informed about current tax regulations and proactively seeking opportunities to lower your tax burden. This can include contributing to retirement accounts, taking advantage of tax deductions for education or medical expenses, and optimizing your investment strategy to minimize capital gains taxes. Working with a tax professional can help you develop a comprehensive tax plan tailored to your financial situation and goals.

Estate Planning

Estate planning is the process of arranging for the management and disposal of your estate during your life and after death. It involves creating a will, establishing trusts, and making decisions about how your assets will be distributed. Proper estate planning ensures that your wishes are carried out and can reduce taxes and legal issues for your heirs. It also includes appointing guardians for minor children and planning for incapacity through powers of attorney and healthcare directives. Regularly reviewing and updating your estate plan is important to ensure that it reflects your current wishes and circumstances. Estate planning provides peace of mind and helps protect your legacy for future generations.

Setting Financial Goals

Setting financial goals is crucial for achieving financial success. Clear, specific, and achievable goals provide direction and motivation for your financial planning efforts. Whether your goals are short-term, like saving for a vacation, or long-term, like buying a home or retiring early, they serve as the foundation of your financial plan. By setting financial goals, you can create a roadmap for your financial journey and make informed decisions about how to allocate your resources. Regularly reviewing and adjusting your goals can help you stay on track and adapt to changing circumstances. Achieving your financial goals requires discipline, planning, and a commitment to making smart financial choices.

Financial Literacy

Financial literacy is the knowledge and skills needed to manage your finances effectively. It includes understanding basic financial concepts like budgeting, investing, and managing debt. Improving your financial literacy empowers you to make informed decisions and take control of your financial future. By educating yourself about personal finance, you can develop healthy financial habits and avoid common pitfalls. Financial literacy also involves staying informed about changes in the financial landscape and continuously seeking to expand your knowledge. Resources such as books, online courses, and financial advisors can help you enhance your financial literacy and build a strong foundation for financial success.